Nftnews Today Bored Ape Yacht Club NFT Prices Plummet After FTX Crash

The crypto market is in turmoil amid information of FTX’s liquidity crunch and alleged mismanagement of buyer funds.

This disaster has despatched shockwaves by way of the NFT market, resulting in panic promoting of NFTs. Because the FTX debacle continues and traders stay unsure about the way forward for cryptocurrency alternate, the ”ground worth” of Bored Ape Yacht Membership NFTs has dropped considerably.

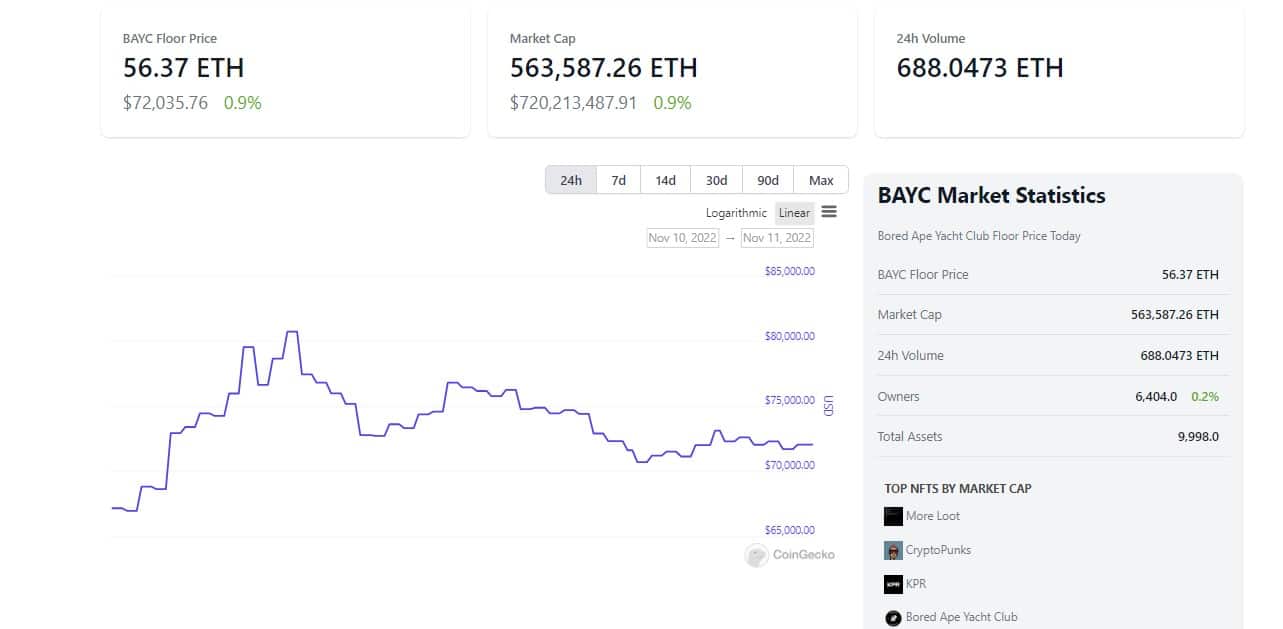

As of this writing, the bottom out there Bored Ape Yacht Membership NFT in the marketplace is listed for 56.37 ETH, or roughly $72,035. By way of ETH, this can be a 7% loss within the final 24 hours. Nonetheless, contemplating the declining worth of ETH (which is down 13% this week), it has plummeted about 24% in USD over the previous day.

The present worth of a Bored Ape NFTs (in USD) has dropped considerably since its peak of roughly $429,000 (152 ETH) on April 29 earlier this yr. That’s an 82% fall.

Causes

There are a handful of believable components driving down Bored Ape’s pricing this week. One issue is general crypto market dread within the aftermath of the FTX crash. It might be pushing some traders to promote their “blue chip” NFT property. Surprisingly, there’s on-chain evidence to assist this behaviour.

WETH trades as a proportion of complete OpenSea quantity is above 50% for the primary time at present. The chart beneath is fairly wild.

Everybody accepting the bids which are on the market.

That is up from 40% once I tweeted this chart earlier. pic.twitter.com/5Zo66UPLfF

— NFTstatistics.eth (@punk9059) November 9, 2022

Additionally Learn: Royalty-Implementing NFTs Might Be A ‘New Asset Class’: Magic Eden CEO, Jack Lu

Increasingly NFT house owners are accepting decrease bids than the market worth. This means that sellers are attempting to swiftly eliminate their NFTs amid the market turmoil.

One other issue contributing to the crypto market’s collapse is BendDAO. It’s a lending system that enables customers to get crypto loans by leveraging their NFTs as collateral. BendDAO is now auctioning off 14 Bored Ape NFTs from liquidated loans, with present bids on all of them far beneath the market ground worth on main market platforms. This means that demand for the property is weak.

BendDAO suffered a severe liquidity problem again in August when it ran out of ETH. And didn’t obtain excessive sufficient bids to public sale the NFTs seized from liquidated money owed. Lastly, protocol contributors opted to lower the liquidation threshold, making it easier for BendDAO to dump NFTs for underwater debt.

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

The journalist is a writer and digital nomad. Loves thinking, learning, and writing about all things Web3, particularly its impact on major creative industries.