Nftnews Today Don’t Miss Blue-chip NFT Bargains

Fears are spreading within the NFT group, as BendDAO, a crypto lending firm utilizing NFTs as collateral, faces liquidation . Now, there’s discuss of wide-spread fire-sales of Bored Ape Yacht Membership NFTs. Nonetheless, there’s extra to the plan than that. Apparently, there’s a stack of Doodles, Azuki and RTFKT NFTs too.

So what is occurring with BendDAO, and how will you get your arms on a Blue-chip cut price?

What’s BendDAO?

Table of Contents [hide]

BendDAO is a lending system by way of which you’ll be able to borrow ETH utilizing your Blue-chip NFTs as collateral. In order the proprietor of a Blue-chip NFT, you’ll be able to entry ETH immediately. Then, these lending ETH get on the spot curiosity. It’s mainly a win-win for customers. In an effort to keep away from losses attributable to the market fluctuations, the borrower may have a 48-hour liquidation safety interval to repay the mortgage.

Why is BendDAO liquidating belongings?

Liquidation is occurring for a couple of completely different causes. Firstly, because of the dropping floor-prices of some Blue-chip NFTS. When this occurs, ‘well being issue’ of the NFT-backed mortgage is dropping under 1. For instance – taking out a mortgage when BAYC is 100eth, you’ll be able to immediately borrow 40eth. But when the ground worth of BAYC drops to 44eth, this triggers the 48 hour liquidation protocol. That is to make sure that the lender recoups their mortgage plus curiosity. We now have seen this taking place this week with BAYC #533 (used as collateral towards a 66.95 ETH mortgage) being listed for public sale.

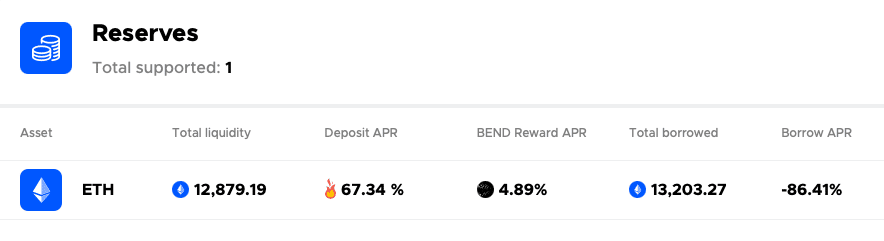

Secondly, BendDAO has discovered itself in a troublesome state of affairs. They’ve solely 12.8 WETH left of their contract. Subsequently, these supplied loans through BendDAO can not retrieve their cash. There may be roughly 13,000 ETH lent at time of writing, so the ETH left of their contract is decrease than the whole loaned ETH. Because of this, the ‘debt’ towards the NFTs is rapidly rising.

How will you decide up a cut price Blue-chip NFT?

With the proposed modifications there might be some superb offers on Blue-chip NFTs coming over the following month. If the proposal passes, they may public sale off quite a lot of beforehand unlisted NFTs. By decreasing the brink for asset liquidation, BendDAO is guaranteeing that NFTs may be auctioned off earlier than the ground drops to catastrophic ranges.

If you wish to watch the public sale exercise and attempt to decide up a Blue-chip cut price, regulate the BendDAO ‘Loans in Auction’ web page to start bidding.

What in regards to the defaulted NFTs?

Nicely, these are up for public sale, however the majority of NFTs auctioned don’t have any bids. Solely 4 of the 17 MAYC at the moment up for public sale have bids. The bids are missing as a result of BendDAO requires bids to be above the quantity of debt AND above the OpenSea flooring worth. Debt may be larger than flooring, and so most individuals don’t need to purchase them. Moreover, to open a bid it’s important to lock up your eth for 48 hours, and it is a threat many will not be keen to take.

So, with no-one bidding on defaulted NFT loans, the DAO is left holding them with a better debt than they’re at the moment value. The DAO must discover a solution to retrieve the ETH from these NFTs to pay the lenders.

To mitigate this, BendDAO is proposing modifications to lending protocol. One proposed change is that auctions will final solely 4 hours reasonably than 48, eliminating the danger of getting your ETH tied up for 2 days. One other change is that the minimal beginning bid might be the whole debt on the NFT reasonably than 95% of the ground worth. Which means the hole between the ground and beginning worth will probably be a lot bigger, incentivising extra bidders.

In conclusion, BendDAO is giving us a lesson on making ready for the bear market within the bull market. Whereas it might really feel comfy utilizing NFTs as collateral in a bull market, the mannequin behind many NFT mortgage firms are nonetheless too primitive. That being mentioned, many within the NFT group are trying ahead to the sale. In spite of everything, who doesn’t love a cut price blue-chip NFT?

All funding/monetary opinions expressed by NFTevening.com will not be suggestions.

This text is academic materials.

As at all times, make your personal analysis prior to creating any sort of funding.

The journalist is a writer and digital nomad. Loves thinking, learning, and writing about all things Web3, particularly its impact on major creative industries.