Nftnews Today Kuma Boss NFT Mint: Here’s What Went Wrong

A latest free-to-mint NFT mission known as Kuma Boss needed to take to Twitter after some embarrassing mint day errors. The mission dealt not simply with good contract points, but additionally a devious mission developer.

What’s the Kuma Boss NFT assortment?

Table of Contents [hide]

Kuma Boss NFT is a set of 5,555 pixelized bears (Kuma is Japanese for “bear”). Mainly these generative NFTs match right into a wider lore centering round Kuma Bosses, every of which oversees its personal shadowy group. As well as, patrons have been capable of mint Kuma Boss NFTs on July thirteenth for simply the price of gasoline. Maybe unsurprisingly, the gathering offered out.

Evidently, Kuma Boss regarded to benefit from the present hype round free NFT mints. As many will know, free NFT mints have surged in reputation throughout the present bear market. To not point out the runaway success of Goblintown. Curiously nonetheless, Kuma Boss did go a barely completely different route than many widespread free mints of late. That’s to say that it truly has a website, in addition to lore.

Sensible contract points affected the Kuma Boss NFT mint

The Kuma Boss group took to Twitter shortly after its mint with a thread outlining every part that went flawed. And the primary problem at hand, was the difficulty with the Kuma Boss good contract.

In brief, the group launched the good contract on OpenSea incorrectly. The group had labeled the contract as “testingggg”. As one tweet from the thread defined,

“this was the title of the testnet assortment and we had modified the title of the gathering on testnets.opensea.io to “KumaBoss” and up to date all related particulars. We assumed this could carry over once we launched our contract on mainnet, we have been flawed.”

Sadly, the group’s response simply opened up a door to extra points.

“As soon as we launched, we noticed the title on Opensea and our brains went right into a state of panic so we thought one of the best plan of motion was to pause the mint and put out a tweet stating that we’ll be launching a brand new contract and everybody who minted can be airdropped a free NFT.

We shortly realized the flaw on this being that those that purchased off secondary can be left with out compensation so we deleted the tweet. ”

The group ultimately consulted with an skilled developer who suggested them to easily preserve the contract and replace the main points on OpenSea. However due to the tweet, there have been minters who offered their NFTs pondering that there can be a brand new contract, thus ending up with nothing.

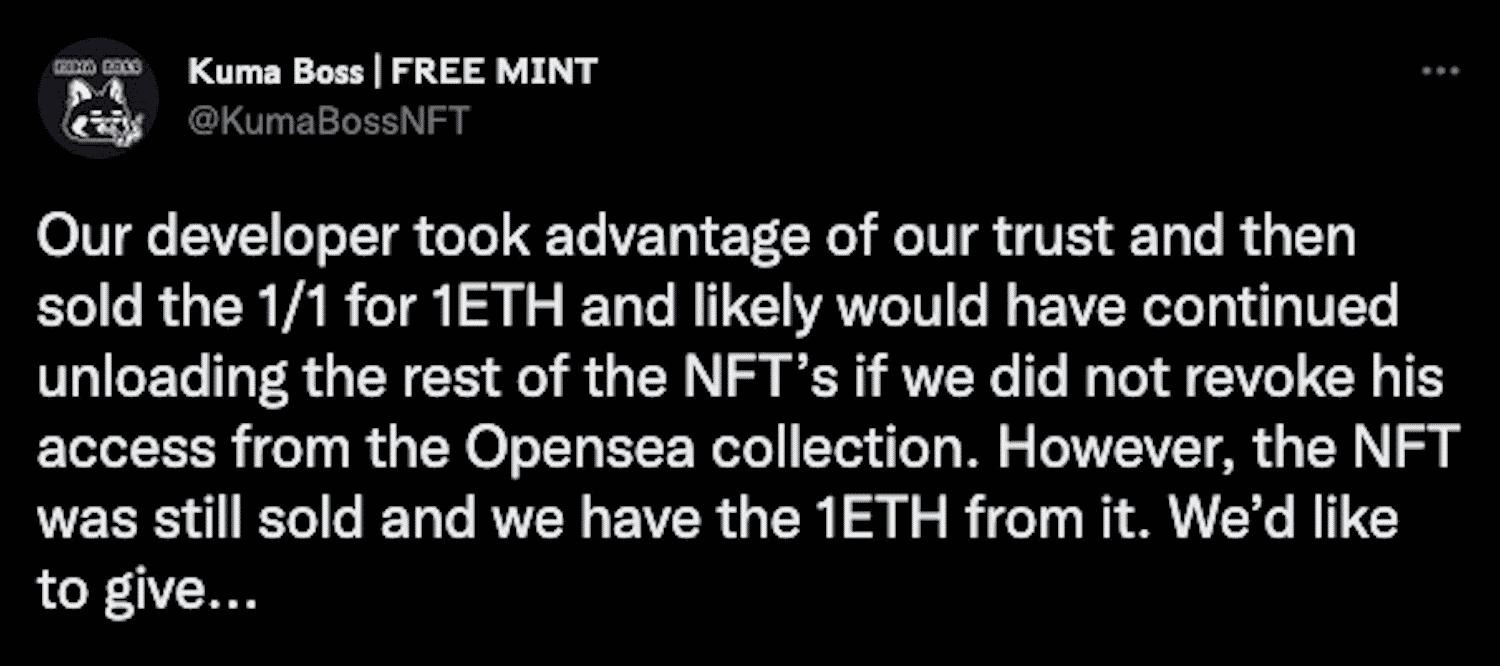

Group’s dev makes an attempt uncommon NFTs from the group allotment

As if the good contract blunder wasn’t unhealthy sufficient, the Kuma Boss NFT group say it “noticed numerous FUD”. This got here as group members began accusing the group of shopping for all of the 1/1s within the assortment.

Because it seems, the Kuma Boss NFT dev did the truth is promote a 1/1 from the 200 NFTs that Kuma Boss held again for its group. Kuma Boss maintains that the group pulled one of many three 1/1s within the assortment “by pure luck”. What’s extra, it revoked the dev’s entry to the OpenSea assortment earlier than the dev may unload any extra NFTs.

All in all, this mint was a horrible search for Kuma Boss, which it acknowledges in its Twitter thread. To that finish, the thread ends successfully promising to regain the belief of the group.

So will it be capable to regain that belief? To be honest, maybe it was a collection of sincere errors because the group claimed. However, Kuma Boss NFT won’t have had a lot leeway to start with. In spite of everything, there are another potential purple flags across the mission.

For one factor, it has an nameless group. To not point out that its Twitter account that went lively in June 2022, but it has 200K followers. To make clear, that’s normally an indication of numerous pretend followers.

All funding/monetary opinions expressed by NFTevening.com usually are not suggestions.

This text is academic materials.

As at all times, make your individual analysis prior to creating any form of funding.

The journalist is a writer and digital nomad. Loves thinking, learning, and writing about all things Web3, particularly its impact on major creative industries.